What are Sovereign Credit Ratings and why are they important?

A sovereign1 credit rating is an independent forward-looking assessment of the creditworthiness of a country – the likelihood that it will reliably service its debts or default on its obligations. Consulting sovereign credit ratings can give investors insights into the level of risk associated with investing in the debt of a particular country, and, thus, will affect the level of interest potential bond holders will demand when a government issues sovereign debt. Having a reliable score is crucial for states wishing to borrow money cheaply on the domestic or international bond markets.

Sovereign credit ratings are typically conducted on the request of a country by one of the big three credit rating agencies: Standard and Poor’s (S&P), Fitch and Moody’s.

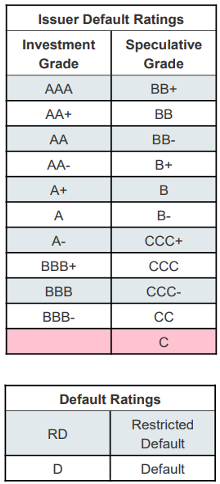

At Fitch, for example, sovereign credit is rated on a scale from AAA at best to C at worst. Any sovereign rated below the BBB- level is considered to be “speculative" and often referred to as "high-yield" or "junk”. This rating is calculated via a multi-step process, but the base begins with the use of a sovereign rating model.

Sovereign Rating Model

A sovereign rating model is constructed from weighted indicators and measures considered to influence a sovereign’s risk of a credit default based around either their willingness or ability to pay their debt obligations. These vary from finance-related indicators such as Reserve Currency Flexibility and Commodity Dependence, to Structural Features such as GDP per capita, corruption, rule of law and regulatory quality, which compromise half of the total weight of the model.

Therefore, if a sovereign is able to improve these fundamentals it can raise its credit rating, and thus lower its cost of borrowing. Developing countries that can access cheaper credit could use this to fund further development and lower their interest payments, which would in turn further improve their credit rating, leading to a positive feedback loop contributing to development and reducing inequality with the developed world.

Sovereign rating models and natural capital

Sovereign rating models are not static. They and their constituent indicators go through regular revisions to improve accuracy based on new research and changing global conditions. For example, since 2015 environmental, social and governance (ESG) factors have played a greater role in the indicators that form the rating models used by the firms.

Currently, Fitch considers GHG emissions and air quality, energy management, water resources and management, biodiversity and natural resources management, and natural disasters and climate change to be potentially applicable to indicators in rating models. However, their ESG relevance scores, which determine whether these factors have a material impact on a country’s credit, remain generally quite low, being usually pegged either as minimally relevant or irrelevant to a sovereign’s rating.

Natural capital matters in this case because many countries that struggle to obtain strong credit ratings often have large environmental endowments of natural capital. Therefore, some feel that if natural capital were to be considered a salient measure in sovereign rating models, it would lower financing costs for developing countries, promote protection of ecosystems and spur development.

However, the raison d'être of rating agencies is not to ensure low interest rates for borrowers, but to provide accurate information on risk to lenders. Without concrete evidence of how natural capital can improve a sovereign’s ability or willingness to pay, it will not be incorporated into sovereign ratings. Such concrete evidence of an effect would take the form of a transmission mechanism. To materialize the supposed beneficial effects of such an incorporation, a strong case for a natural capital transmission mechanism would need to be made.

Transmission Mechanisms

Transmission mechanisms are theoretical pathways through which a measure or other factor could influence the indicators that form a credit rating model. For example, the discovery of a large resource endowment, such as oil, could improve a country’s expected GDP growth through higher exports, thus improving credit rating, while simultaneously leading to commodity dependence and consequent risks in terms of price fluctuation and governance problems arising from the resource curse, creating a counter effect on the model.

Transmission mechanisms “transmit” risk from the ESG or financial factor to one of the indicators in a rating model. For natural capital to be a relevant factor, it requires an evidence-based transmission mechanism to translate it into a credit-relevant indicator for the sovereign rating model.

An example of how this can apply to natural capital and ecosystems that Fitch highlights is how deforestation, soil degradation and land loss lead to reduced agricultural and mineral productivity, which could affect credit-relevant indicators through the transmission mechanisms of higher competition for raw materials, quotas and stricter regulation on producer’s activity – including rationing and priority for local firms – and supply chain shortages and competition disrupting downstream businesses. These transmission mechanisms can result in economic and fiscal impacts that effect creditworthiness such as:

- Loss of revenue due to reduced productivity

- Increased relocation costs to move operations or access new land

- Higher raw material costs from competition and new suppliers

- Fines, legal settlements and loss of operating licence from illegal activities

- Reduced exports and tax revenue from lower productivity

If such a transmission mechanism could be demonstrated empirically to have a significant impact on these measures, then natural capital considerations could become relevant to sovereign credit ratings.

Natural wealth, sovereign credibility, and the inconclusive relationship

A paper by the World Bank released in April 2021 estimates the relationship between natural capital and government bonds on the secondary bond market, a useful proxy of the market’s assessment of a country’s credit risk. The paper found that investment in renewable natural capital (forests, water, food provisioning, etc.) within a country decreases that country’s bond yields (suggesting a higher credit rating and lower risk profile would be appropriate).

Analysis shows that as countries grow richer in renewable sources of natural capital wealth, their cost of borrowing drops. Countries that have become richer in renewable natural wealth between 2009-2019, such as Colombia, have experienced significantly lower borrowing costs, even after controlling for an array of macro-financial variables. This effect is strongest for forest capital and to a lesser degree agricultural land. The hypothesis is presented that forest and agriculture represent worthwhile investments into natural wealth, which fosters sustainable growth and improves the country’s fundamentals, and thereby decreases the country’s default risk resulting in the observed lower bond yields.

However, this result is inconclusive and lacks a demonstration of the hypothesised transmission mechanism beyond a correlation. The distinction between preserving biodiverse old growth forests and measuring the effects of large-scale forest plantations is also unclear. While transmission mechanisms for natural capital may hold promise, more research in the topic is needed to make a strong case.

Footnote

- S&P Global Ratings, February 2019, How We Rate Sovereigns. Available at: https://www.spglobal.com/ratings/_division-assets/pdfs/021519_howweratesovereigns.pdf

***

GGKP Explainers draw on the latest research and knowledge to provide deep dives into themes or topics relevant to the GGKP's current projects. They are drafted and curated by the GGKP team and deliver factual insights to green growth practitioners and experts.